By Mike Walsh

Every business will transition. In the majority of cases, the business ownership often represents a significant percentage of a business owner’s wealth, decades of hard work and frankly has become a part of their self-identity. When a business owner makes the decision to transition, this can be a difficult process to navigate without bias and emotion. In addition to managing the day-to-day operations of their business, they will likely need to address questions and concerns related to value, deal structure, due diligence, tax impact, what’s next, impact to key employees, family, etc.

While the following themes will apply differently to each unique owner, business and situation, it’s important to keep these in mind whether the business is being sold, passed on to employees or shift to family members. It’s important to evaluate your needs before the transition and ensure you have the best pieces in place to maximize your outcome, whatever that means to you.

#1: Set transition goals

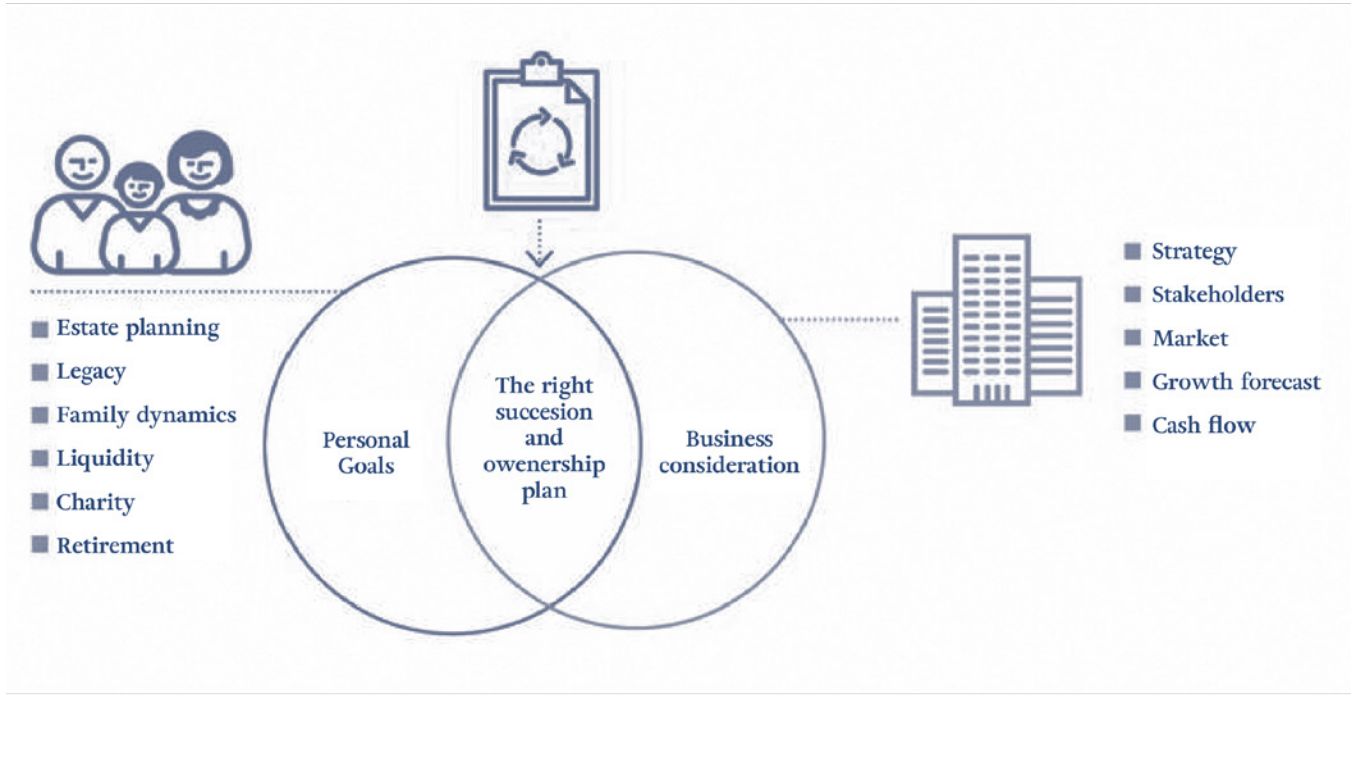

At face value, this might sound simple. However, many business owners don’t realize initially that there are financial goals and non-financial goals. It’s extremely important to prioritize the goals, as they can seem to be most important when evaluated in isolation. As an example, as the business owner, you may want to maximize value, but that might conflict with taking care of key employees. Other goals include minimizing tax impact, transitioning to family, transferring ownership to employees, etc.

#2: Make time your friend

One of the big mistakes I see business owners make is starting to work on their transition too late. By starting too late, business owners are not able to get the most favorable terms and/or meet their personal expectations for transition and end up frustrated.

#3: Personally prepare for your transition

While this might seem obvious initially, it can become complicated because there is a financial side, but also a psychological side that oftentimes conflict. As a business owner, your business has been your life for many years, and some of your personal value is tied to the business.

It’s also important to understand that structure, timing, etc. can affect after-tax cash flow and result in a different standard of living. What does this mean? It’s important to evaluate your needs before the sale and ensure you have the best pieces in place to maximize your outcome. It’s also important to plan in advance and understand the implications on your estate and philanthropic objectives.

What will you do after transition?

#4: Choose your transition path

There are many different paths to transition the business including internal buy out, ESOP, M&A, family transfer and IPO. Most business owners have not taken the time to learn about the pros and cons of each. Each of these are significantly different and can lead to vastly different outcomes.

Conclusion:

Conclusion:

Knowing these key issues can help business owners maximize their outcome and more efficiently achieve their financial and non-financial objectives. Keeping the goals in mind throughout the process can serve as your guiding star as you navigate difficult decisions.

About Mike Walsh

Mike is a Financial Advisor with Wells Fargo Advisors. As a Financial Advisor with Wells Fargo, he is able to provide access to various groups within the firm that have access to some of the best resources available for any financial situation. Mike’s focus is on guiding clients through changes of circumstance, liquidity events, and planning for the future.